A while ago I wrote about starting my own small business. It’s a really small business. Just me in the garage evenings and occasionally on the weekend. It’s now about eight weeks in and it might be a good time to go through some of the simple lessons that I have learned and, in some cases, relearned during this process. I have to admit that many things I knew, learned before and even suspected, still hold true.

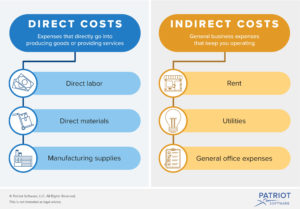

The first thing that was reinforced was the decision as to whether or not this was to be a real business, or what I would call a “hobby”. The baseline for this decision is how Cash Flow is treated. A hobby is something where you are aware of your expenses, but do not fully track them, as the difference between personal and business expenses can be somewhat blurry. In a hobby you know you are spending the money, but you’re not so worried about it as it has an entertainment value as opposed to a baseline for profitability.

For the business, I chose the tactic of keeping all receipts and tracking them (and revenues) via a spreadsheet. I set aside my initial cash investment for equipment (saws, sanders, grinders, etc.), as well as the initial payments for the raw materials that I would need to make the product. I viewed this as my Class “A” funding, to use entrepreneurial lingo. I didn’t want to have to go back to my investor (me) and explain to myself how my initial business case was flawed, if I in fact ran out of cash.

Fortunately, actually not fortunately, it was according to plan – orders did start to come in quickly.

Now came the balancing act of trying to grow. That meant ramping up production, which in this case meant making a couple more game boards than I actually needed each week, in order to build a little inventory. It is October, and the gift giving season will be here soon. It does take some time to build the products, and I am planning on a continued sales ramp through the end of the quarter. I would like to have some products on hand to turn into revenue as quickly as possible.

I don’t however have the ready cash, as part of my plan, to be able to just start producing fully in anticipation of such demand. Such is the balancing associated with cash flow. How much can you spend and how quickly can you get it back.

Another topic was quality. As I continue to produce the boards, I get better at it. I not only get better, I also get faster. I have gained confidence. I began to think I had it figured out. It took one inferior product produced to bring me back down to reality.

I am my own best, or in this case worst critic when it comes to what I produce. If it is not good enough for me, then it doesn’t get sold or shipped to a customer. Those resources, time and materials spent on making that inferior product were wasted. I will not get them back. It brought home the cost of quality, or in this case non-quality very quickly.

Speaking of manufacturing, as I mentioned I continue to learn how to manufacture better and faster. The old adage “practice makes perfect” does have some application here. I have gotten faster and more accurate at the measurement and cutting aspects of the process. I have learned that it is faster and easier to cut, and recut a straight line, than it is to try and sand a straight line. I have refined, changed and in some cased reduced the amount of raw materials required to manufacture. As might be expected it has had a beneficial effect on my bottom line.

As an aside, I have also learned that as soon as you bend what was once a straight piece of metal, it will never be straight again, no matter how long or hard you work at straightening it. Just a tip for those who may also decide to try and work with metals.

The value of having some inventory, as opposed to only starting to build when an order came in has shown its value. I have already mentioned the balancing act between tying up a lot of cash in inventory versus having it available for other expenditures. But it turns out that customers are actually pleased when they get their desired product faster than when it is promised to them. I recently had my first return customer (he originally bought a small board, and he came back to buy a large one). He mentioned that it was both product quality and the fast shipment that brought him back.

Imagine that.

Next comes looking for opportunities to expand both the market for the existing products and looking for new types of products to create. As I said, I am making metal game boards (and game pieces) for Chess, Checkers, Go, Pente and the like games. They seem to be pretty well accepted, at least initially by my go to market channels (in this case on-line purchasing sites eBay and Etsy).

The questions are:

Are there other board games that may be readily adapted to a metal platform?

And

Are there other channels to market for the existing and potentially new metal boards?

I am currently working on a potential backgammon board as a product platform expansion. Backgammon is an older and widely played game. I will not make many boards to start as it will be a much more involved manufacturing process (involving much more difficult angle cuts as opposed to the current right angles I use now). It may actually require outsourcing to a machine or cutting shop, at least initially to get it done. I will see how this goes.

As to expanding channels to market, on-line still appears the way to go for now. It continues to provide the broadest market coverage, while still providing the lowest investment associated with merchant systems and the like. I will continue to look at other artisan and mercantile type sites to see what it may cost to put my products up on those sites. That way I will be able (hopefully) to continue to expand the number of people who can see and purchase my products.

I have looked into attending trade and other types of craft shows, as another channel to market. These may be viable channels in the future, but I am not so sure right now. Almost all of these events require a registration fee of some type. Applying this fee against the margin I get from each product sale tells me how many boards I must sell during the course of the show (usually two days over a weekend) in order to just break even. It also means that I would have to probably invest a little more heavily in inventory as customers who attend these shows normally like to go home with the products that they buy at these shows. Not having available product to deliver would probably limit sales success here.

Most importantly, the weather is still nice, and I would like to golf at least once on the weekends as I continue to work at my chosen career during the week. Once the weather changes and it begins to get a little colder and a little less desirable to play golf, I will probably revisit the trade and craft show decision.

Did I mention that priorities are a must when starting your own business?

Finally, I come to marketing. I have the website up. It can be viewed at https://metalgames.biz/. I have the purchase and merchant systems working on Etsy at https://www.etsy.com/shop/MetalGames?ref=seller-platform-mcnav. I have started to get customer reviews (all positive so far) and am making sure that they are visible on both sites.

The next step was to create a site and presence on Facebook. It seems to be the granddaddy of all social networks at this point. Again, this is a relatively simple process. Facebook has all the required information to quickly lead you through how to set up a page for a business. Mine can be viewed at fb.me/MetalEnterprises. It seems that “Metal Games” was already taken by someone. Such is life.

I am looking into other media sites such as pinterest. I was actually just out there looking and trying to quickly understand their process and methodologies for getting “pins” out there. I will see if I can get that social media capability up and working in the next day or so.

Several things are similar for a one-person garage shop and a ten-thousand-person multi-national company. Knowing where your cash is and how quickly you can get back what you have spent dictates what your cash flow is. Profitability is great and will ultimately dictate longer term success, but cash flow is what allows you to keep the doors open. Product quality is a premium. “Good Enough” is not anywhere near good enough. Set your personal thresholds high and do not compromise. It matters. Continuing to seek out new customers and being as responsive as is possible to those you find will always be the keystone for business success.

And, as is the case for me at Metal Games (as in most of the work I do) have fun.